Venture capital is evolving—and so must LPs. In today’s evolving venture capital landscape, capital alone is no longer the differentiator. High interest rates, compressed valuations, prolonged exit timelines, and a rapidly transforming AI-native world have created a new set of questions for Limited Partners (LPs): Where is real value created? Who has access? And what does long-term alpha actually look like? In this exclusive NuFund webinar, we dive into how top emerging fund managers are navigating this reset—crafting sharp investment theses, uncovering overlooked opportunities, and building conviction-led portfolios in high-complexity sectors. Whether it’s quantum and deep tech, AI, healthtech, university spinouts, or dual-use defense technologies led by veteran founders, this session will reveal how sharp GPs are carving out differentiated access in today’s reset. For LPs—whether family offices, direct investors, or strategic angels—this is a chance to go beyond the check and gain a clear framework for evaluating GPs, participating in co-investments, and building durable access to early-stage innovation.

Who Should Attend?

This session is curated for:

- Accredited Investors, Family Offices, and Direct Investors seeking smarter access to high-performing, next-generation venture funds

- Emerging LPs looking to understand how to evaluate fund managers, develop an LP thesis, and engage effectively

- Experienced Investors interested in deepening their exposure to differentiated co-investment opportunities with strategic GPs

Note: This is not a general-interest webinar. It is intentionally limited to participants who are—or should be—investing in early-stage venture capital.

What You’ll Learn

- How top GPs craft and evolve sector-specific investment theses

- The “must-ask” due diligence questions for evaluating emerging managers

- What risk, liquidity, and return look like in early-stage funds

- Why veteran-led startups offer unique execution advantages—and how dual-use tech expands exit potential

- How LPs get closer to founders and opportunities through co-investments and secondaries

- What to not expect: why this asset class demands patience, rigor, and alignment

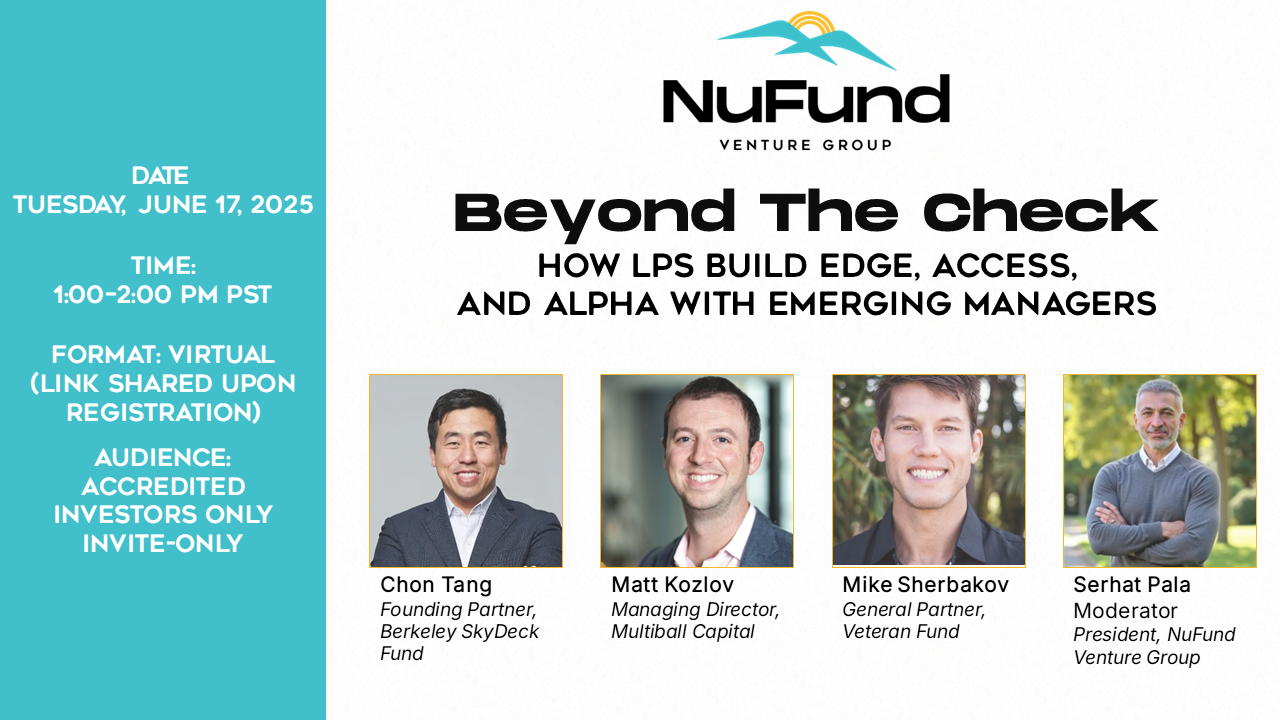

Meet the Panelists

Chon Tang – Founding Partner, Berkeley SkyDeck Fund

Combining academic rigor with global market reach, Chon Tang has transformed UC Berkeley’s startup ecosystem into a venture capital powerhouse. Through the Berkeley SkyDeck Fund, he backs over 100 research-driven startups annually, sourcing from top-tier university talent and scaling them with corporate and international LP partnerships. His specialty lies in de-risking deep tech spinouts with a methodical, data-backed investment playbook.

Matt Kozlov – Managing Director, Multiball Capital / (Former Managing Director Emeritus, Techstars LA/Healthcare/Space)

Previously Managing Director of Techstars LA, Healthcare, and Space programs, Matt Kozlov is known for backing transformative technologies across verticals—from aerospace and defense to healthcare and AI. Now at Multiball Capital, he brings his accelerator-honed instincts to seed-stage investing, focusing on founders solving high-complexity problems in overlooked markets. His superpower: helping early-stage teams accelerate from concept to traction at lightning speed.

Mike Sherbakov – General Partner, Veteran Fund

A Marine Corps veteran turned impact-driven VC, Mike Sherbakov co-leads The Veteran Fund—a Silicon Valley firm investing in dual-use and critical technologies built by veteran founders. Veteran Fund targets companies innovating in cybersecurity, AI, advanced manufacturing, and space—where military experience aligns with mission-critical innovation. Mike’s edge lies in his ability to connect high-integrity operators with a national network of defense, business, and policy leaders. He’s also the Managing Director of Founder Institute SoCal and founder of Greatness Ventures, combining startup acceleration with social impact. His mission: empower veterans to build the next generation of tech leaders shaping America’s future.

Moderator: Serhat Pala – President, NuFund Venture Group

As President of NuFund, Serhat oversees one of the nation’s largest and most active early-stage investor groups. He plays a key leadership role in NuFund’s evolution as a “Venture Group”—a collaborative platform where LPs invest, learn, and lead together. Serhat is also an emerging GP with a focused thesis: backing immigrant founders building transformative businesses in the U.S.

Why Attend?

NuFund’s innovative “Venture Group” model transforms early-stage investing into a collaborative powerhouse. This webinar underscores our commitment to:

Expose NuFund’s 300+ investor members and strategic co-investors to fresh, impactful investment theses.

- Educate family offices and LPs on effectively evaluating and strategically engaging with emerging fund managers.

- Foster meaningful connections between NuFund investors and specialized venture GPs for robust co-investment opportunities.

- Whether you currently invest with NuFund, are exploring new fund strategies, or simply want to deepen your market insight—this session is designed to significantly expand your strategic understanding.

Reserve Your Spot

This webinar is invite-only and limited in capacity to maintain an interactive, high-signal discussion. Register below to join our Zoom webinar on Tuesday, June 17th at 1 pm.